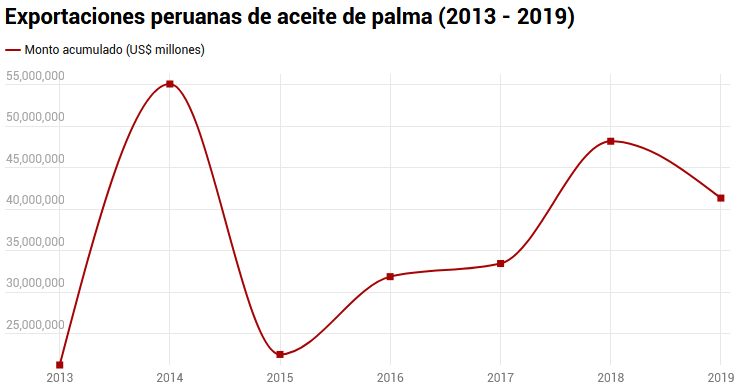

Since 2013, palm exports in Peru increased in 94%. The boom has gone hand in hand with social conflicts in agricultural areas, complains for deforestation in the Amazon region, and land trafficking. The Romero Group concentrates most of the industry, but still cannot guarantee the total use of palm in its supply chain which does not come from destroyed forests. Their company plans state that they will only be able to do so after 2025. The main export destinations during these years have been Colombia, Chile and Ecuador.

Soap, necessary to deal with the current Covid-19 pandemic, is largely made with palm oil. It is a silent ingredient in many products we use daily: from vegetable oils, cookies and detergents, to milk, bread, chocolates, and cosmetics. Their components include some of this input or its derivatives. The growing global demand for this product, which is rooted in social conflicts and deforestation, has forced many companies, such as the transnationals Nestlé, PepsiCo, Kellogg or Procter & Gamble, to adopt standards in their processes that guarantee that the oil used does not come from palm cultivated in destroyed forests.

These standards are based on environmental criteria developed by the Roundtable on Sustainable Palm Oil (RSPO), which must be met by its more than 4,000 members, including seven Peruvian companies. Annual reports to RSPO show that none can still guarantee the sustainable use of palm in 100% of their supply chain. Not even the companies in the Romero Group that have exported more than two-thirds of refined oil and crude oil (69%).

If we separate the products, the Romero Group has an almost full monopoly of exports of refined oil (98%), and controls just over half of the foreign trade of crude oil (58%). This industry does not have much time in operation. Eight years ago there were no exports, but in the past seven years, 346 thousand tons (US$ 253 million) of crude and refined palm oil have been exported nationally.

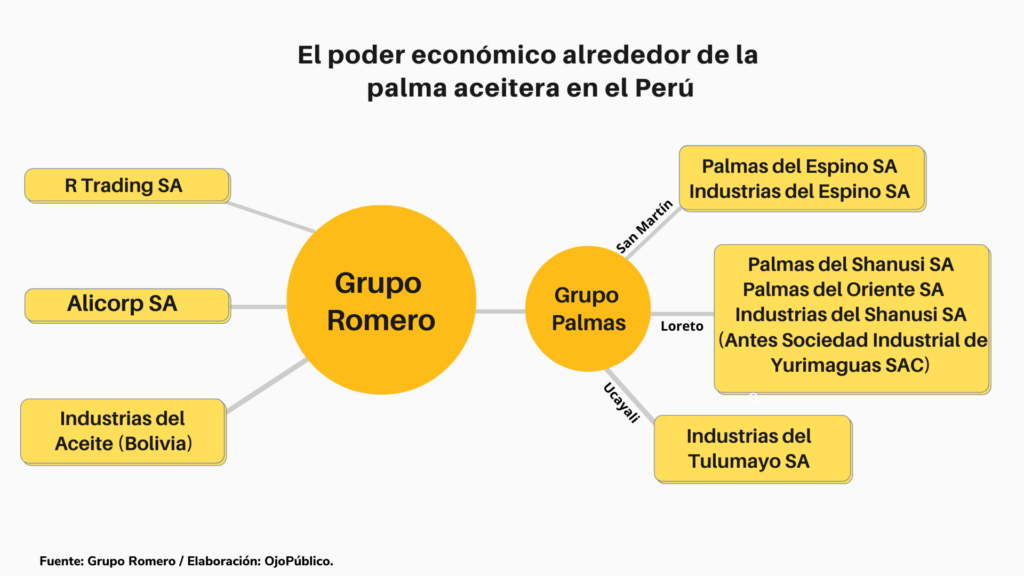

According to figures from the National Superintendency of Customs and Tax Administration (SUNAT), in seven years (2013-2019), the Romero Group exported palm oil through four companies: Industrias del Espino SA (the largest exporter in the country with 39.5%, a value of US$ 100.2 million); Alicorp SA (25.7% or US$ 66.2 million); R Trading SA (3.5% or US$ 6.5 million) and Sociedad Industrial Yurimaguas SAC (today Industrias del Shanusi SA, with 1.7% or US$ 3 million).

However, the buoyant business of the country’s largest oil palm exporter is overshadowed by official investigations linked to deforestation and irregular environmental certifications.

This is shown by a recent court ruling of December 2019 for a case of illegal environmental certifications for agro-industrial oil palm projects of companies in the Romero Group. This case stirs the debate on the control of this industry. In the judgment, the Superior Court of Justice of Lima sentenced the former Agricultural Environmental Affairs Management Director from the Ministry of Agriculture, Ricardo Gutiérrez Quiroz, to four-year of suspended sentence for having illegally approved in 2013 the environmental certifications of four palm projects in Loreto belonging to companies of the Romero Group (Islandia Energy SA, Empresa Desarrollos Agroindustriales Sangamayoc SA, Empresa Agrícola La Carmela SA and Empresa Palmas del Amazonas SA).

The projects were located in areas of Amazon forests and would cause deforestation, but as the prosecution was initiated, they did not start operations. According to the English NGO Environmental Investigation Agency – EIA, 23,143 hectares were at stake among the four projects (“Maniti“, “Santa Catalina“, “Tierra Blanca” and “Santa Cecilia“), just over 30 thousand times the field area of the National Stadium of Lima. According to the judgment, the decision of the agricultural authority was to cause irreversible environmental damage against the Amazon region.

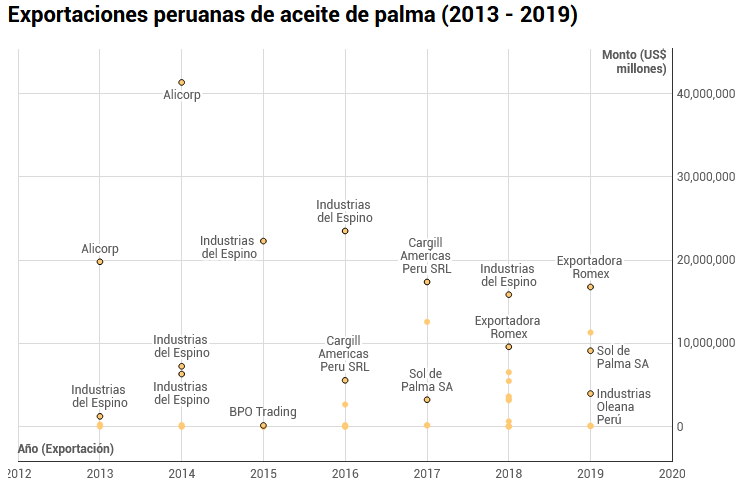

Although there are still no data on exports of crude palm oil in 2019, from 2013 to 2018 exports of crude and refined oil from the most prominent companies of the sector, such as Alicorp and Industrias del Espino, grew by 39%. Unlike their competitors, both companies always exported in the last seven years, although since 2018 their volume has declined, especially Alicorp (from US$3.6 million in 2018 to only US$89 thousand in 2019). If, in the last two years, the export of companies from the Romero Group reduced their exports, the opposite happened with four of their closest competitors: Industrias Oleana, Sol de Palma, Cargill Americas Perú and Exportadora Romex.

For example, exports from Industrias Oleana account for 2.8% of exports since 2013 (S/7 million with only two years of activity). This company started operations in October 2018 and its parent company is based in Ecuador. It has more than 50 years of experience in the country and since 2012 has been the main exporter of products derived from oil palm in Ecuador.

In the case of Sol de Palma, exports represent 8% of the total. The company went from selling US$ 62,000 in 2015 to US$ 9 million in 2019. This company, which began its operations in 2011, is defined as a consortium of six palm-growing companies working with 3,500 small- and medium-sized producers in the country.

North American Cargill Americas Peru SRL exported 9%, although it exported only in 2016 and 2017. It started operations in 1953 and its parent company Cargill is based in the United States. This US firm, with a presence in more than ten countries of the region, was part of a report by former member of the US Parliament and now president of Mighty Earth, Henry Waxman, where he noted that Cargill had poor environmental practices in their oil, cocoa, and soy production processes.

Finally, Exportadora Romex SA had 10.6% of all exports only in 2018 and 2019. This company was incorporated in May 2009, as a product of the of the Romero Trading Coffee and Cacao business division. According to their activities, they market and deliver services related to agro-industrial activity, such as the export of coffee, cocoa and cocoa derivatives. Their main brand is Cafetal.

These four companies together account for 30.5% of the exports from 2013 to 2019. The rest has been in the hands of the four companies of the Romero Group.

The companies of this economic group have a presence not only in the export stage, but in the entire oil palm production chain: from harvest to extraction, refining, production and marketing. They participate in all this process with a number of companies and with three extraction plants, which pool a working capacity of 140 tons of palm per hour, while their closest competition, the Ocho Sur Group, achieve only 45 tons of extraction per hour. The following infographic shows the business structure of the economic group in the oil palm industry:

The first destination of the oil

According to estimates by the Peruvian Oil Palm Board (Junpalma), Alicorp dominates 80% of the national refining market of the sector. The palm derivative that Peru has exported the most is crude oil, which is almost threefold the exports of refined oil.

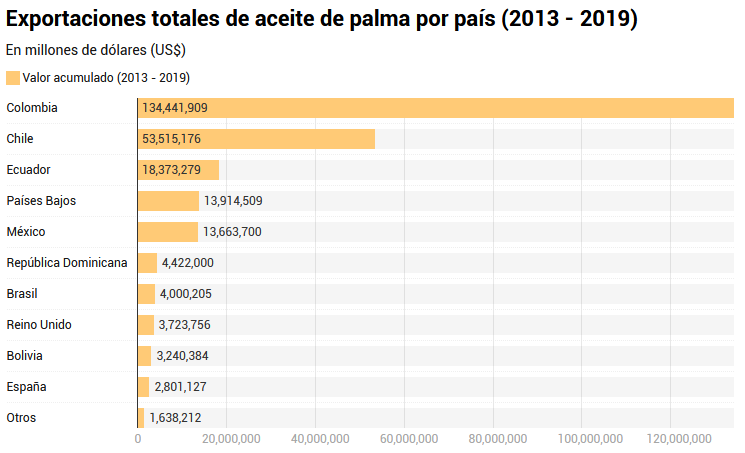

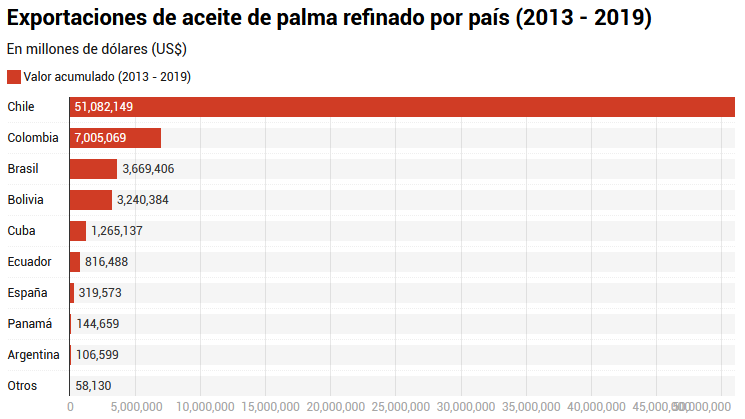

The palm market in Peru began to revitalize in 2013. The three main destinations of Peruvian palm oil in the last seven years were: Colombia (US$ 134.4 million), Chile (US$ 53.5 million) and Ecuador (US$ 18.3 million). The chart in this section shows the full list of countries.

To explain the progress of exports, we will focus, to begin with, on the case of refined palm oil.

For example, of the fourteen destinations for this type of oil between 2013 and 2019, nine are Latin American countries, with Chile as the main buyer. In seven years, the southern country paid US$ 51 million for the more than 56,000 tons purchased from companies in Peru. Their purchases increased exponentially by 2,700% until 2018. Foreign trade of this product with Chile has accounted for three quarters of all exports since 2013.

From that year until 2018, Chile and Bolivia were the only countries that bought Peruvian palm every year continuously. Colombia, in turn the leader in palm exports in Latin America, is the second country that has bought the most from Peru. It is followed to a lesser extent by Brazil, Bolivia, Cuba, Ecuador and Spain. A 97% of exports of refined palm oil were sent by the company Industrias del Espino SA between 2013 and 2019. During that period, the company’s business grew by 1,470%: it went from exporting US$ 700,000 in 2013 to US$ 11 million in 2019.

Industrias del Espino SA is part of Palmas Group, an agro-industrial branch of Romero Group, which also markets finished products such as soap, oil, and butter. According to Minagri 2012 report, “the company marketed 90% of their production in the Peruvian jungle at that time, where they have the monopoly of the oil market. Because of their competitive prices it has displaced products coming from the coast and even those imported from Brazil.”

This company also manages a significant portion of processing plants throughout the country. By the end of 2018, they purchased 100% of the shares of Industrias de Grasas y Aceites (Igasa) corporation, which work in “the manufacture and marketing of plant and animal soaps, oils and fats, the industrialization of candles and other related inputs”.

The Guarantee of Sustainable Palm

Together with seven other companies of the Romero Group, Industria del Espino SA is a member of the Roundtable on Sustainable Palm Oil (RSPO) which, as we mentioned at the beginning of this report, is a non-profit organization that provides worldwide certifications for sustainable oil palm production to all its members (from producers, processors and traders to investors and transnational corporations such as Nestlé or Procter & Gamble).

The RSPO monitors that its members comply with international standards and ensure that they use 100% sustainable palm and RSPO-certified palm products throughout their production chain. In other words, RSPO make sure they provide guarantees that the palm they use does not come from deforested areas or other illegal activities.

Certifications are also used to establish chain traceability. “Currently, we have 20% RSPO certified oil in the world, but still 80% is not. Therefore, we understand that change in the businesses do not happen overnight, it is a process. Then, with these commitments, our intention is that companies make their corporate decisions transparent regarding sustainability,” said RSPO Director for Latin America, Francisco Naranjo, in an interview with OjoPúblico.

Industria del Espino SA, represented before RSPO by another company in Romero Group: Palmas del Espino SA) has proposed to the RSPO in their last annual report submitted, that in 2025 they would achieve a 100% certification of their entire supply chain. This type of certification is renewed every year after the RSPO checks the progress and the attainment of the goals proposed by the company, until they achieve the certification of their entire supply chain, explained Francisco Naranjo, RSPO Director for Latin America.

In other words, only then will Industrias del Espino SA guarantee that there is no palm coming from deforestation in their supply chain. This intention to certify also the suppliers includes mainly the small independent producers in the country, from whom the companies in the Romero Group buy a total of 91,438 tons of fresh fruit bunches (according to Palmas Group website), that represents 13% of their total supply.

In short, the RSPO gives its members an ISO that provides them with credibility and openness in the markets. Therefore, the companies in the Romero Group are interested in receiving these certifications. OjoPúblico found that foreign companies that have purchased the most Peruvian palm oil are RSPO certified. In theory, as members of the RSPO, they should enter trade agreements with their peers who have the same certification.

Another RSPO powers is to receive complaints about deforestation against companies, audit their work and punish them. There is a Peruvian case in its file that illustrates the irregularities of the palm industry in our country.

In April 2016, the RSPO ordered to stopthe Pucallpa plantation operations (now under another name and part of the Ocho Sur business group). This decision was based on a complaint by the Santa Clara community in Uchunya, which accused the company of destroying more than 5,000 hectares of their ancestral forest and intimidating their leaders, among other irregularities. In their investigations, the RSPO confirmed many irregularities in what the company did and ordered their operations to be paralyzed. When RSPO was processing the complaint, Plantaciones de Pucallpa left the organization.

At the beginning of 2018, as part of a precautionary measure requested by the Ministry of the Environment legal advisor, the Fourth National Preparatory Investigation Court temporarily suspended the activities that were then operated by Ocho Sur in the Tibecocha area of the district of Nueva Requena and adjacent to Santa Clara de Uchunya.

In February of this year, the Ucayali Regional Government handed over to the Santa Clara de Uchunya shipibo community a property title for over 1,544 hectares. However, many areas have been divided, generating disputes in this community, and in the control of Plantaciones de Pucallpa (who became Ocho Sur P SAC, the second business group, after the Romero Group, with more palm crops in the country with more than 10,000 hectares).

Ocho Sur P and Ocho Sur U are the new legal names of what used to be Plantaciones de Pucallpa and Plantaciones de Ucayali, respectively. The Czech-American businessman Dennis Melka had been the director of the last two, until the judicial investigations began to emerge; therefore he is considered to be involved in the Ochoa Sur Group until today.

In Peru, there are seven companies and associations members of the RSPO. Perhaps the biggest challenge for these companies and those of the Romero Group is to ensure the 100% use of both sustainable palm oil and RSPO-certified products throughout their supply chain.

For example, Oleaginosas del Peru S.A has offered to comply with this commitment in 2026. Industrial Alpamayo has been set 2023 as their deadline; Industria de Palma Aceitera de Loreto y San Martín S.A has offered to comply in 2030. In turn, as we already mentioned, Industrias del Espino (represented by Palmas del Espino) points at 2025; however, Alicorp believe they will be ready to ensure that sustainable palm is used throughout its supply chain in 2030.

This company, the most important one in food industry in Peru, explained the 10-year term: “Achieving a RSPO certification for our palm crude suppliers represents a long-term intervention, considering that the informality in which they operate in the productive sector and the lack of resources to invest in closing gaps. We believe that this work could take, in the best scenario, from 2 to 5 years of work and, in some cases, up to 10 years to be completed.”

OjoPúblico found that foreign companies that buy most of Peru’s oil palm are RSPO certified. This is the case with the two companies that bought the most refined palm in the last seven years. Both are Chilean. The third-place company is Bolivian and belongs to the Romero Group. These three companies concentrate 70% of total purchases of refined palm since 2013.

The Main Buyers

The largest buyer of refined palm oil is Camilo Ferrón Chile S.A., for US$ 22 million in six years since 2014 (equivalent to one third of the total foreign palm trade since it began exporting in 2013).

The company’s purchases grew by 114.5% until 2019. Camilo Ferrón Chile SA has more than 70 years of experience in the production of vegetable oils, margarines and butters. They have been a member of the RSPO since August 2013 and in their 2018 report indicated the use of sustainable RSPO-certified palm oil and palm for a year. The company committed to having 100% sustainable palm oil in its supply chain starting in 2030. OjoPúblico contacted the company, but at the close of this publication it had not responded to our inquiries.

In the second company buying the most of refined Peruvian palm is Chilean Watts S.A. for an amount of US$ 12.7 million. This amount represents 18.8% of the total exports of this type of palm since 2013. In seven years, the purchases of this company grew by 1,280%: from only US$ 203,000 (2013) to US$ 2.8 million (2019).

Watt’s S.A. was founded more than 80 years ago, and is today a conglomerate of companies linked to the Chilean and international food and wine industry. Their board is controlled by the Larraín family, one of the wealthiest in Chile. In Peru, they own 37% of the shares in Laive, sharing control with the Peruvian family Palacios Moreyra. Watt’s S.A. is one of the five most important suppliers of major supermarket chains in Chile such as Walmart and Cencosud, and has a significant participation in the production of all kinds of milk, yogurt, cheese, margarines, edible oils, juices, nectars, jams, preserves, fresh pasta, and wines.

This company has been a member of RSPO since 2014. In their 2018 report, they indicated that they would use RSPO-certified sustainable palm oil only since 2020. Regarding the question on the 100% use of RSPO-certified sustainable palm throughout its supply chain, the Chilean company also indicated that they would adopt this standard in 2020. Why didn’t they do it before? The company explained in its report that “their suppliers might have problems, but that was not their responsibility.” Watts did not respond to our inquiries either.

In the third place, we find Industrias del Aceite S.A., based in Bolivia, with more than US$ 11 million in purchases in seven years (17.7% of the total). This company has been part of the Romero Group since 1974 and its purchases have grown by 117% since 2013. We will come back to this company later.

Although Industria del Espino SA has 97% of the exports of refined palm oil, they leave Alicorp with a minimum sales margin. The three companies that have bought most from Alicorp are also Chilean: Importadora y Comercializadora (US$ 263,000); Inmobiliaria e Inversiones Kori Wasi (US$ 74,000) and Importadora y Alimentos ICB Food SE (US$ 40,000). The proportion of exports from Industria del Espino SA compared to Alicorp is 90 to 1. But their places are reversed when we look at exports of crude oil palm.

Weed Around the Industry

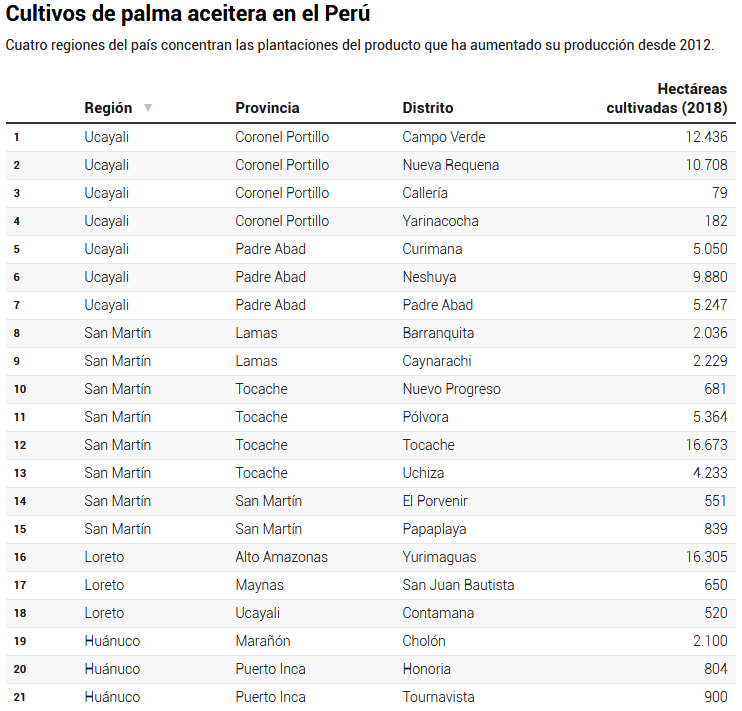

According to figures from UN Food and Agriculture Organization (FAO), Peru ranks seventh in palm production in Latin America. At the top of the list we have Colombia, Guatemala and Honduras. In the region, Peru’s crops have accounted for 3.7% of the total over the past seven years.

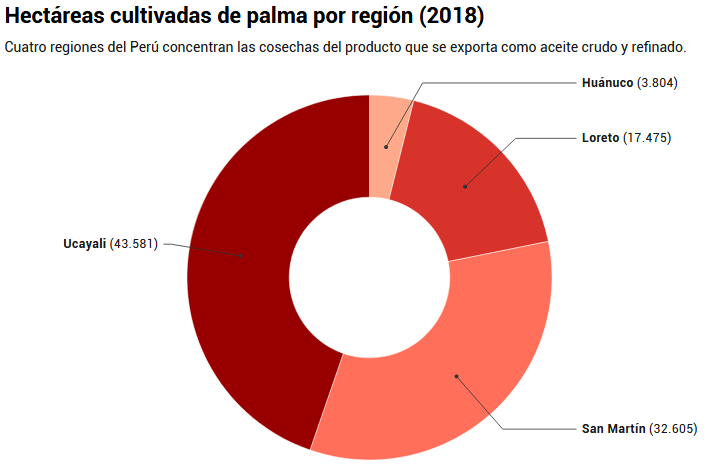

In perspective, compared with Colombia (32.30%) or Guatemala (15.3%), the Peruvian industry is still small, but its rise is undeniable: palm production increased by 56% from 2013 to 2018. However, more and more facts and complaints prove that the growth of the palm industry seems inevitably linked to social conflicts, deforestation, land trafficking, and violence against Amazon populations in the country.

Eight months ago, in September 2019, and after six years of investigation by the environmental prosecutor’s office in Yurimaguas, The Superior Court of Justice of Lima resolved a complaint involving Palmas de Shanusi SAC, a company in the Romero Group, for the deforestation of 500 hectares of forests in the San Martín region, in order to expand its oil palm cultivation borders in the area.

The judgment acquitted two company representatives (Ronald Campbell García and José Mercado Bartolo, then general manager and legal representative of Palmas de Shanusi SAC, respectively), accused of being the mediate authors of slashing and burning forests; in addition, no registry links for the land was found for the company.

However, Milton Artiaga Díaz was sentenced to four years’ imprisonment. He was accused of felling and burning 500 hectares of forests (almost 700 soccer fields), without a license to do so and having purchased land from a number of small owners. Artiaga Díaz, born in the Amazon region and identified by the prosecution as an independent worker, is the manager of Agroservices Altomayo EIRL, a company working in the agricultural and livestock sector.

In his statement, Artiaga Díaz (47) indicated that he had purchased land for agriculture and livestock, and that he did not remember how much he had paid to each owner, but that he did so with his savings and in cash. The prosecution argued that it was not credible that the defendant had bought the land on his own, as he could not prove the origin of the money with which he paid them. For the prosecution, Artiaga Díaz had been in charge of purchasing the land on behalf of Palmas de Shanusi SAC and the direct responsible for deforestation. The sentence ordered payment of half a million soles of civil damages, and reforesting the area for the irreversible damage caused. Prosecutor’s sources told OjoPúblico that the case is on appeal pending hearing.

In recent years there has been an “interaction between large companies and networks of land traffickers” where “several of the past projects have had a degree of irregularity in the way they have accessed the land,” explains specialist Juan Luis Dammert, researcher and Director for Latin America at the Natural Resources Governance Institute (NGRI).

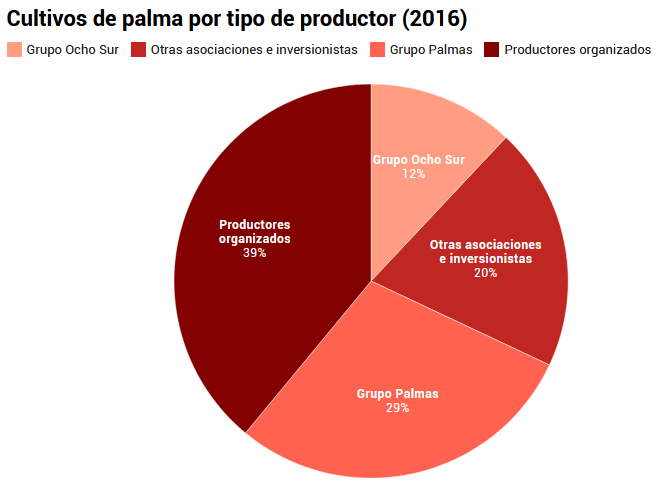

Although there are no updated official figures on palm crops and production (officials of the Ministry of Agriculture told OjoPúblico that the information on the subject is available at the offices of each regional government), according to Devida, Ocho Sur is the second largest private group with palm crops nationwide. Until 2018, they owned 10,040 hectares, representing 12% of 86.000 hectares of crops nationwide (the Palmas Group ranks first with 29%, just over 25,000 hectares (33,000 times the field of the National Stadium in Lima).

In mid-2019, OjoPúblico revealed the scheme used by the land mafia in Ucayali. The documents in the prosecutor’s file show the participation of ghost farmers’ associations and former officials of the agricultural management in the same regional government. The prosecutor’s investigations describe a system that allowed the award of land for farmers’ associations represented by alleged front-men, and to be later sold to businesses linked to oil palm cultivation, such as Ocho Sur (formerly known as Plantaciones Pucallpa SAC), a company linked to US-Czech businessman Dennis Melka.

The evidence pointed to the former head of the Ucayali Agriculture Directorate and to the former Director of Sanitation and Land Titling of this office, as heads of an organization that traded at least three thousand hectares of land. According to the prosecutor, they simulated an award of 128 pieces of land to relatives and friends of former workers of the Ucayali Regional Agrarian Directorate, to later sell them to palm companies like Ocho Sur.

The case is still under investigation – today at the organized crime prosecutor’s office in Lima – and is called ‘Cocha Anía’. This is the name of the area where the land to be sold in Nueva Requena is located, a district today in the center of the criminal disputes of land invaders. In this Ucayali jurisdiction, six farmers were killed in the midst of a land-trafficking conflict in 2017.

Where does crude oil go?

Unlike refined oil, crude oil is extracted directly from the fruit. In other words, it has not gone through any chemical and industrial process modifying the original product. It is refined to make the most elaborate products like butter, cookies, cleaning products (disinfectants, detergents). Crude oil can be a raw material for biodiesel.

Alicorp SAA is the country’s largest exporter of this type of oil, with 34% of the total exports in the last seven years, even though they only exported for three years: 2013, 2014 and 2018 (US$ 64 million altogether). In the second place is the other company of the Romero Group, Industrias del Espino S.A., which exported just over half of what Alicorp did (18% of the total), even though they have not exported since 2016. However, in the last four years, three companies competing with the Romero Group have increased their exports: Exportadora Romex SA (US$ 26 million or 14% of the total), the US company Cargill Americas Peru (US$ 22 million or 12%) and Sol de Palma (US$ 20 million or 11%). Only Cargill is member of the RSPO.

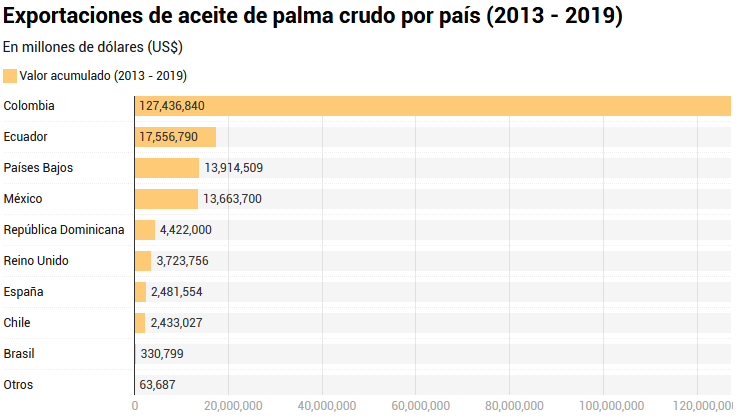

Colombia is the first destination to which crude palm oil is exported. Since 2013, this country has been buying this product. Of the twelve destinations of palm oil, eight are Latin American countries. Colombia’s purchases represent 68% (US$ 127 million) of the total over the past seven years, with a 129% growth in volume. Ecuador follows, although falling behind in volume of purchases: 9.4% (US$ 17 million).

Purchased made by that country increased by 2.4% since 2013. Ranking third and fourth are the Netherlands with US$ 13.9 million (the names of the companies are not specified) and Mexico with US$ 13.6 million.

Those who buy the crude oil

The company that has purchased the most crude oil from Peru is Colombia’s Tequendama SAS (23% of the total sold since 2013). This company only bought oil for three years (2014, 2015 and 2016). Unlike refined palm oil, where three companies concentrate 70% of exports, crude oil – with the exception of Colombia’s Tequendama SAS – there is not much different in the volume of purchases made by the other buyers.

Tequendama SAS is part of the Daabon group, a conglomerate with a presence in agriculture, industry, logistics and real estate. The company is a member of the RSPO. In their 2018 report, they pointed out that since 2011 they had been processing RSPO-certified palm oil. They also indicated that starting in 2021 they would achieve the RSPO certification for 100% of the palm supply chain. The press area of this company informed that they were going to respond to our inquiries, but at the close of this report they did not answer our messages again.

In the second place we have Mexico’s Industrializadora de Oleofinos, with a share of 9% of the total exports from 2013 to 2019. This company is part of the Oleomex group, one of the largest agro-industrial companies in that country. It produces dairy products, oil, breads, soaps, and other food products. He has been a member of RSPO since August 2009. In their 2018 report, they express that they have been using RSPO-certified oil palm certified since 2015.

They also point out that only in 2028 their production based on sustainable palm will reach 100% of the RSPO standard. The company explains this deadline as follows: “In Mexico, there are about 11,500 small producers, with an average of 8 hectares per farmer, making it very difficult to organize them for certification.”

In the third place is Ecuador’s La Fabril S.A., their purchases represent 8% of the exports since 2013. Their products in the food category include oils, margarines, butters, dressings. In the field of cleaning products, they manufacture disinfectants and dishwashers. The have been members of RSPO since November 2018, through their holding company La Fabril S.A. In their 2019 report they informed that they had started working with RSPO-certified palm oil that year. 2023 is the target year to ensure the use of 100% sustainable palm products in all their supplies.

Together, Alicorp and Industria del Espino SA concentrate 58% of crude oil exports (US$ 98 million). Alicorp is the main exporter with US$ 64.4 million. Among its clients, we find Tequendama SAS, mentioned above, and the Dominican company Mercasid S.A., a producer of beverages, margarines, oils and cleaning products. Mercasid S.A. is a product of the merger of Sociedad Industrial Dominicana (SID) and Mercalia, S.A.

In 2009, Mercasid S.A. purchased Clorox brand. Other companies that are listed as purchasing from Alicorp include Ecuador’s La Fabril S.A. and the UK’s Aarhuskarlshamn UK Ltd (AAK). The latter is based in Sweden and produces margarines, butters, oils, edible ingredients and baking products, food manufacturing and retail sales.

We were unable to identify companies buying 35% of Alicorp’s crude oil exports. We only know that this represents US$ 23.3 million, and that almost half of it goes to the Netherlands and the rest to other Colombian companies.

Latest news from the jungle

There are photographs from last April of palm-laden trucks leaving the district of Nueva Requena in Ucayali. The country was in full quarantine and the members of the Santa Clara de Uchunya community took the pictures. They claim to know the drivers. The leaders we interviewed (and who prefer to remain anonymous because of the constant threats received) say that the Ocho Sur Group is beginning to transform the palm extracted from their production areas in the Ucayali region. They mention that even during the quarantine the trucks have transported some of the fruits to the San Martín region to be sold to the Romero group.

This last 30 April, in the midst of a state of emergency, the Ombudsman’s Office asked the Environmental Assessment and Control Agency (OEFA) to ascertain whether Tamshi SAC (cultivation of cocoa in the Loreto region) and the Ocho Sur group (oil palm) were operating despite the pandemic. A week later, OEFA responded indicating that both companies would be supervised. In the case of Ocho Sur, he indicated that he had a November 2019 supervision “the results of which showed the existence of suspected non-compliance, among which activities without an environmental management instrument approved by the competent authority”.

In a new communication sent on 15 May, the Ombudsman’s Office requested the OEFA to prioritize the audit against the mentioned companies and, if necessary, “impose the relevant administrative measures”. To date, there is no response from the supervisory body, which has not responded yet to our requests for information on the register of sanctioning administrative processes for the agricultural sector.

State surveillance on this issue seems mild. The OEFA administrative processes search engine has not reported any penalties. The tool was updated to November 2019 and its search criteria do not include the agriculture and irrigation sector that corresponds to the cases of palm oil companies. At the close of this report, the OEFA press office had not responded to our enquiries on the subject.

The Ocho Sur business group carries over the liabilities of the former owner (Dennis Melka). As we indicated, in April 2016, the RSPO ordered to stop Plantaciones de Pucallpa operations (now with another name and part of Ocho Sur) until they can show compliance with all the legal requirements in the acquisition, logging and planting of the concession area and proving not having cleared the primary forest or another area of high conservation value, and not having been notified before the start of the company’s activities.

According to RSPO, “the complaint mentions the devastating impacts on rivers and the forest ecology on which community members rely for subsistence, the destruction of community homes and the restrictions imposed on community members who want to enter the forest.” The shipibo community of Santa Clara de Uchunya indicated that more than 5,000 hectares of its forest were destroyed (half of Paris, one quarter of Montevideo).

When consulted on the possibility of Ocho Sur joining RSPO as an active member, the director of RSPO for Latin America, Francisco Naranjo, told us that the “issue of the pending complaint should be clarified” before and that it was difficult (to know) whether or not they could be accepted because the case should be analyzed and understand its relationship with Plantaciones de Pucallpa.”

OjoPúblico also consulted Ocho Sur whether they were planning to achieve a certification of compliance with sustainable palm production standards, for example by becoming an official member of the RSPO. The company’s sustainability manager, Ulises Saldaña, told us that they were working on several options “that would allow us in the near future to establish ourselves as a company aimed at promoting the growth and use of sustainable oil palm products through global standards, and RSPO was one of these options, as it covers not only the application of principles of transparency, law enforcement and regulations, best practices, environmental responsibility, resource conservation and biodiversity, etc. but, especially, responsible consideration with employees, individuals and communities, topics that we are very interested in developing.”

Mentioning the deforestation cases in which the company and its former owners were involved, the Ocho Sur sustainability manager told us that “there were no judicial issues about deforestation investigations, but fiscal investigations. We are aware that they are currently being processed before the relevant authorities”.

When asked about the activities at their processing plant in Ucayali that started operations this year, and whether Alicorp was the end-customer for the palm oil they extract, or how their product was diversifying, the manager said he couldn’t tell us because of a business strategy issue and because of the confidentiality that his customers owe and demand. He also avoided responding if they were thinking of exporting their oil and what destinations they were considering. On June 9, after the publication of this report, Alicorp sent a letter to OjoPúblico by e-mail pointing out that they had never had any commercial relation with Ocho Sur, and that their palm oil comes from 9 extraction plants that bring together 7,000 families cultivating sustainable oil palm as producers associated with Junpalma.

In Peru, there are 19 palm oil processing plants; according to Junpalma, 68% of them are in the Ucayali region. In this area of the country, by the end of last year, Ocho Sur started operations at their extraction plant with a capacity of 45 tons per hour. This volume makes them the second largest in the country, behind Palmas Group, which has three plants with a joint capacity of 140 tons of palm per hour in the San Martín and Loreto regions.

Before the palm enters the extractors, the Palmas Group supplies 86% of the production from its own plantations, but the rest (91,000 tons of fresh palm fruit bunches) comes from third parties. When we asked Alicorp about how they were ensuring that the palm oil they export did not come from deforestation, the company sent OjoPúblico a letter to Llorente y Cuenca consulting firm. They told us that the extraction plants supplying them with palm “have committed themselves and have formally declared that they do not, or will not supply us with bunches of fresh fruit from deforested land”.

Alicorp explained in their e-mail statement that in 2018 they had designed “a responsible procurement policy to strengthen their chain management and compliance of standards by our suppliers”. They have not responded us if to date they have a registry of suppliers sanctioned or removed from their supply chain because they could not guarantee sustainable palm oil.

For RSPO director for Latin America, Francisco Naranjo, the exporting companies – members of this organization – must meet their commitments and assume “their responsibility” while reporting on their suppliers. “Alicorp should have made public who he buys from. That information is public. All members of the RSPO are obliged to provide this information to any interested party who asks them.” However, we asked Alicorp for this information, but the company did not respond until the close of this report.

For the period 2018-2019, the RSPO audited the supply chain of Alicorp. Auditor Leonardo Gomes, author of the report commissioned by IBD Certificações Ltda, explained the process to OjoPúblico via e-mail:

– Leonardo Gomes: Alicorp did not buy RSPO-certified products such as palm oil. They probably bought non-certified oils but in those cases we did not record purchases.

– OjoPúblico: What do you mean when you say that Alicorp did not purchase or sell RSPO products?

– Leonardo Gomes: There were no purchases or sales of RSPO certified products, so we have no information regarding Alicorp supply base. They were audited under 2017 version of the standard.

– OjoPúblico: So in their audit, you did not detect that Alicorp had purchased RSPO-certified raw material, in any percentage?

– Leonardo Gomes: Exactly. But as I said, it does not mean that they have not bought conventional oil.

– Ojo Público: Is there a supplier list in the auditing processes? What information is taken in to account to certify the supply chain?

– Leonardo Gomes: During the audit, we find out [who are] the suppliers, but only if they are also RSPO-certified. We do not audit conventional suppliers. For the next audit, due to an update of the standard, we will do so as they will have to provide this information publicly.

– OjoPúblico: Will that new audit be conducted at the end of this year? When are you planning to conduct it?

– Leonardo Gomes: The next audit would be by the end of 2020.

Junpalma’s former General Manager, Gregorio Sáenz, believes that the palm production route is “traceable because everything goes down the same road and there are 19 oil palm extraction companies clearly defined in the country.” Saénz also points out that companies such as Alicorp must provide information about who they buy palm from and how much. “Each company reports the palm exits from the field to the Ministry of Agriculture and the Ministry of Production.”

Meanwhile, a draft land-use change regulation is being prepared at the summit of the Ministry of Agriculture. This is linked to the desire to expand the palm sector, Luis Alberto Gonzales-Zúñiga, the outgoing director of the National Forest and Wildlife Service (Serfor), explained in an interview. He talked about the recent interests and obstacles he encountered in the Ministry of Agriculture in his quest to improve controls in the forestry sector and that triggered his sudden dismissal from on 5 June, precisely on the World Environment Day.

Given the lack of capacity and willingness of the State to regulate and watch this industry better, we can only expect that the main Peruvian oil palm producing and exporting companies will self-regulate their processes and ensure that all their suppliers in their production chain meet international standards. It will take several years for this to happen. Amazon forests and their communities will continue to be at risk.